Crippling College Debt

After a long high school career, seniors are ready to graduate, but the impending cost of higher education has become overwhelming.

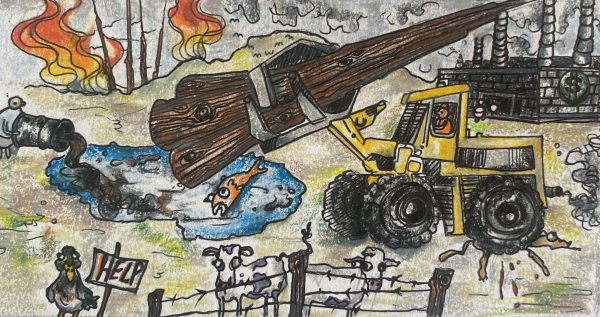

Throughout grade school, the pressure to achieve has weighed on the shoulders of young students everywhere. Success can be defined in many ways, but the traditional idea of it has always been completing a college education. Many students continue onto this path, but the crippling costs of attending a university have become too much for young minds.

Marketplace describes that 70% of students attend college after high school, but the tuition has increased 1120% since 1978. Currently the “average student graduates with more than 25,000 in loans to pay off, and the nation’s graduates owe a cumulative 1.2 trillion dollars.” This has hurt newer generations because of anxiety and affordability, limiting their options and their chances to buy basic needs such as houses and cars.

There are solutions to help limit debt after college. According to Unity College, an option that students can consider is hybrid learning. Especially after the pandemic, students can take classes online to pay less and finish unnecessary classes. Transferring credits can also lower the cost of education, as well as applying for scholarships and other forms of financial aid. There is also the option to test out of courses, lowering the price. Taking jobs on campus or using work study programs can also pay off some debt, and repayment plans can spread tuition out over time to help with debt.

Although this crippling issue threatens the security of students everywhere, there are solutions to take. Higher education is important, and the ability to afford it is also a critical factor. Students today need to heavily consider these variables before attending a university, because the rest of their lives will be affected.